Every business needs a bit of help sometimes, and, fortunately, there’s a marketing agency for every occasion.

The financial technology (fintech) sector is no different.

Fintech services are moving at a rapid pace which can make it difficult to build a consistent brand for yourself and get out in front of a crowd. What’s more, the financial markets themselves are finicky and liable to change on a whim, which makes it even harder to pin down a reliable marketing strategy.

This is where a digital marketing agency specifically catered to helping fintech services can be of great benefit.

So, let’s dive into the details and get to grips with what a fintech marketing agency is and how they can help your brand cut through the over-saturated crowd to bring in some amazing customers.

What is fintech?

If you’re new to the business, then it may help to quickly recap what exactly fintech is.

As previously mentioned, fintech means ‘financial technology’, i.e. any tech and software-as-a-service (SaaS) that helps manage your or other people’s finances. This includes, but is not limited to:

- Lending platforms

- AI financial advice and services

- Mobile apps

- Budgeting apps

- Blockchain and digital currency

- Brokerage services

- Crowdfunding

When we talk about fintech companies, we mean any online banks or financial services such as:

These companies provide a technological service to help users manage their money online without the constraints of traditional banking.

What is fintech marketing?

As with any business, fintech companies need to be able to market their goods and services effectively and accurately. This is where having a strong content marketing strategy is vital, especially in the financial world where a seemingly infinite amount of brands are battling to not only sell to a user, but also to have a customer’s money invested in their product.

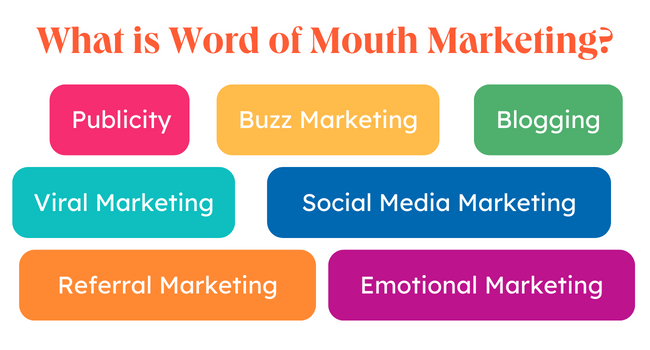

The marketing techniques fintech companies use to attract their target audience aren’t much different from those used by any other business, but it’s worth exploring the nuances of these tactics anyway. So, let’s take a look at a couple of marketing strategies you could potentially use and why they’re important specifically to the fintech industry.

Useful fintech marketing strategies

Before we look at some of the agencies you can use, let’s take a look at a few strategies you can start working towards right now.

Build a strong community

When it comes to investing and handling money, people want to know that their service providers are reliable, capable, and trustworthy. Fintech companies can spend all the time in the world trying to convince users of this fact, but it’s far more effective to let your existing users speak for themselves and generate buzz via word-of-mouth.

Whilst we may be less inclined to believe the promise of safety from a faceless company looking to keep hold of our money, we may be swayed by the opinion of real people who have proof and strong testimonials.

Make money interesting and fun

Often people associate sorting out your finances with scary, difficult practices which have disastrous consequences if you get something wrong. In this case, it’s important to put a new spin on things and try to show your customers how interesting and easy it can be to organize your money.

Gamification is a great way to get people involved and keep them on top of things, encouraging them to be sensible with their finances without the weighty pressure of failure. Setting progress awards for how much money you can save or invest helps incentivize people to achieve their goals.

Unique content types such as leveraging augmented reality (AR) and virtual reality (VR) can make your product more interesting to customers. For example, it can help you visualize your money better, or create a more immersive experience when trading. Concepts such as crypto currencies and blockchain technology are still quite novel to a large number of people. AR and VR can help explain these concepts more effectively.

Offering rewards such as vouchers and discounts to much-loved brands can encourage user retention, as what they do on your app can result in tangible benefits. This is great if you partner up with more and more brands and expand your reach, which will not only gain you more recognition amongst other companies, but will also incentivize more people to check out which great deals you have on offer.

Be strategic with social media

Social media marketing may seem like a piece of cake, but there’s a lot more that goes into it than you may first have assumed. There are a lot of factors that go into whether or not your posts get any attention, such as:

- How visually interesting they are

- Which social media platforms you’re using

- Who your target audience is

- Whether you’ve used search engine optimization (SEO) to boost your keyword rankings

If you’re trying to engage with a younger target audience but don’t know much about how to do that, having a person on the inside, advocating for you, is a huge help. Influencer marketing is when an online personality helps to promote your services as part of a deal. When some influencers have an audience of tens of millions of people, this is hugely beneficial to you.

Growing your online presence helps to increase your brand awareness, so don’t just limit yourself to basic marketing efforts. Actively go out there and connect with other brands, talk about the causes you believe in, and show that you are there to make positive change. By connecting with people about important topics, you can build a sense of authenticity and relevance.

How can a fintech marketing agency help you?

One of the hardest things to do as a new fintech business is build trust with your audience. Whilst there may often be an entrepreneurial venture capitalist waiting in the wings to invest in your product, it’s no good if the general public aren’t receptive to the uptake.

You need someone with previous market experience who is there, ready to help you make the best of your marketing services. Welcome to the stage: fintech marketing agencies.

These helpful corporations are made up of individuals who have vast experience in the fintech sector, and can provide high-quality help and advice about how to grow your brand.

So, whether you’re a giant conglomerate or an eager, passionate startup, marketing agencies are here to help anyone and everyone achieve their fullest potential.

Let’s see what they can do.

Lead generation

Lead generation is one of the ultimate goals in any digital marketing strategy. It’s the process of identifying, targeting, and attracting new customers to get them interested in your products.

Specialized agencies can help you by optimizing your inbound marketing strategies, allowing you to target your customers more effectively. They can also help you find an audience in the first place, which is essential if you don’t know where to look.

One way this works is, if you already have a rough idea of who you want to target, you can provide a list to your agency and they’ll do the rest, opening up new marketing channels in order to reach these prospective clients.

A common mistake new brands make is inundating their audience with loads of marketing material all at once. This can be quite off-putting. Agencies will filter through this and decide on the best bits which get your point across most effectively.

Effective marketing campaigns

There are many routes agencies can take to help bolster your marketing campaigns, including:

- Email marketing: Cold-emailing marketing may sound off-putting, but agencies are there to make the most of your efforts and bring in a new stream of customers. Emails allow you to personalize your content a lot more and optimize it to hopefully generate more leads and reach people you wouldn’t have been able to otherwise.

- Pay-per-click (PPC): PPC means that advertisers may pay a small fee whenever their advert is clicked on. Whilst this may sound counterintuitive, PPC allows marketers to be front and center on a results page and generally leads to a very nice click-through rate (CTR), with good return on investment (ROI)

- Social media marketing: Navigating social media can be a nightmare since there’s just so much of it. Agencies can narrow down your scope and help direct you to exactly where you need to be to reach the most amount of people. They can also advise you on which campaigns are the most effective, such as the medium you use to get your information across, how you lay out your social media, and how you can automate it effectively.

Customer support

Customer relationship management (CRM) can be tricky. You may find that clients are disappearing at a worrying rate, and your customer churn is higher than you want it to be. Having strategies in place to make sure your customers feel happy and supported is one of the best things you can do.

Agencies can help advise on how best to approach and engage with your users, such as through automated chatbots which allow for 24/7 customer support. Open lines of communication between customer and company means that no one feels unsure about the safety of their finances. In such an important industry, clear and consistent messaging opportunities are vital.

Having a handle on your public relations at all times helps avoid conflict in the long-run. Make sure you’re always there for your customers when they need you, and keep tabs on your social media in case any questions come through there, too.

SEO advice

The workings of Google’s search engine are a mystery to many, but there are ways agencies can help you stay on top of the results page. There are differences here to normal marketing, since fintech companies need to place an emphasis on their trustworthiness rather than simply the services they provide.

A good marketing team will be able to help funnel customers effectively with SEO, ensuring that only the best parts are seen first. This gives you time to build up a rapport and get your potential users invested in the security and safety of your product before they commit to investing in it.

5 fintech marketing agencies people love

1. Alloy (formerly ARPR)

Alloy was founded in 2015 and began its life as a public relations firm before they decided to change direction and look more towards the security and compliance side of fintech endeavors. Now they are a fast, scalable option for any financial services company looking to automate their marketing plan and achieve rapid growth.

They use pre-built integrations that tap into over 180 data sources to keep your business ahead of any potential fraud or data risk complications, ensuring that your customers always feel safe and secure.

2. Baldwin & Obenauf Inc. (BNO)

BNO is one of the oldest and most respected names on this list, having been founded in New Jersey in 1981 as an entirely woman-owned and woman-led organization. As a creative agency, they work with more than just fintech businesses, but this has allowed them to operate alongside clients like Nike, New York Life, and Johnson & Johnson.

When it comes to fintech operations, they offer a plethora of services including:

- Branding

- Search and media analysis

- Editorial

- Digital

- Content management

Check out their case study with MasterCard to see how they could similarly help you.

3. CSTMR

CSTMR is an excellent digital marketing services agency who specialize in helping you develop the best advertising campaign possible. Their strategists are here to help you improve your advertising capabilities, polish off your web design, and eliminate the challenges that stand in your way.

They have several solutions and ways of operating, including building organic traffic or generating buzz with performance marketing and paid media advertising.So, whether you’re interested in B2B marketing or B2C lead generation, you can be sure that CSTMR will help you develop an award-winning branding that’ll sweep people off their feet.

They’ve already partnered with organizations such as First Rate, Lendstream, and the healthcare payment group AccessOne, developing expert brand personalities and flawless website design, which have directly helped generate millions of dollars in additional funding for their clients.

4. Growth Gorilla

Despite their small size, Growth Gorilla has grown to notoriety as a full-service agency that knows just how to help provide the correct marketing solutions for whatever goals you have in mind.

To start you off, they present four options depending on what you want to achieve:

- Go-to-market

- Growth

- Market entry

- Product launch

Depending on which of these routes you wish to take, they then have a variety of services to go with it, including:

- Strategy development

- Influencer marketing

- User acquisition

- CRM management

- Digital design

- Conversion rate optimization

They also include a plethora of information about the latest fintech rankings, the best podcasts, and the top yearly events, which is essential information for any company to know, especially smaller businesses looking to find their footing.

5. Inbound FinTech

Finally, we have Inbound FinTech, winner of the ‘Best Fintech Marketing Agency’ awards 3 years in a row, as well as a host of other accomplishments such as the HubSpot Impact Awards for best sales enablement, marketing, and website design.

This award-winning group does it all, and their team of certified experts can help you build an effective growth strategy in no time. They help with:

- Organizing and optimizing the user interface for your services for the best user experience

- Content creation and strategy

- Setting up ads on LinkedIn for greater brand awareness

- SEO and organic growth, as well as PPC

Ready to go?

The financial market has the opportunity to be highly lucrative, which is probably why so many people are interested in it. But for those fintech brands among you who are genuinely looking to make a positive impact, then remember to always put your customer right at the core of what you’re doing.

Marketing agencies will help facilitate this, and guide you in the right direction for how to achieve it. It’s all well and good trying to stick it alone and forge your own path, but just be prepared to not see many results for a while. Especially for fintech startups, agencies are the way to go. Don’t leave it up to chance. Use data-driven statistics and expert analysis to help become the best that you can be.