At the start of 2023, the fintech industry means big business.

Financial technology is a thriving industry. In 2026, it is thought to reach a value of $324 billion. But it can seem like an overstuffed market. With over 26,000 startups seeking new customers, the idea of a product claiming a substantial market share seems daunting.

Enter a high-quality marketing strategy.

With a well-executed fintech marketing strategy, you can raise brand awareness with your target audience.

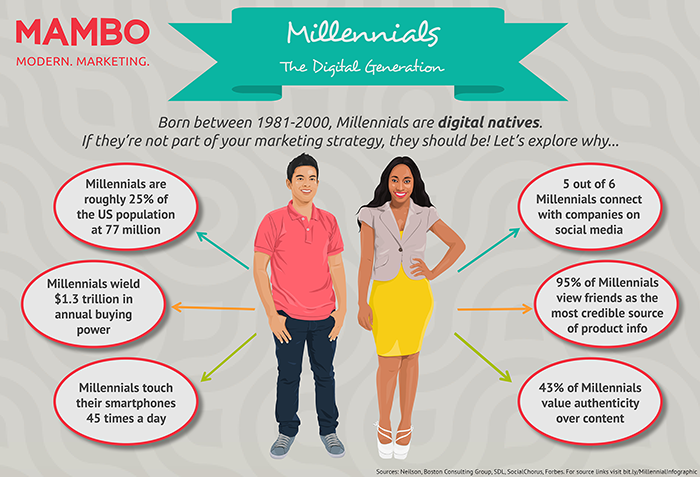

But who are these potential customers that you seek? Say hello to the Millennials, the new target audience of many financial institutions.

At first, it may seem that you will need to invest in a large marketing team to build a hot fintech brand made for Millennials. But this is not the case.

All you will need is this blog and a willingness to learn new marketing tactics. So, sit back and let us show you the following 5 fintech marketing examples from which you could learn a thing or two from.

- Monobank

- Betterment

- Zettle

- Curve

- GoodBox

The Millennial market

Millennials are the basis of the modern world we live in today.

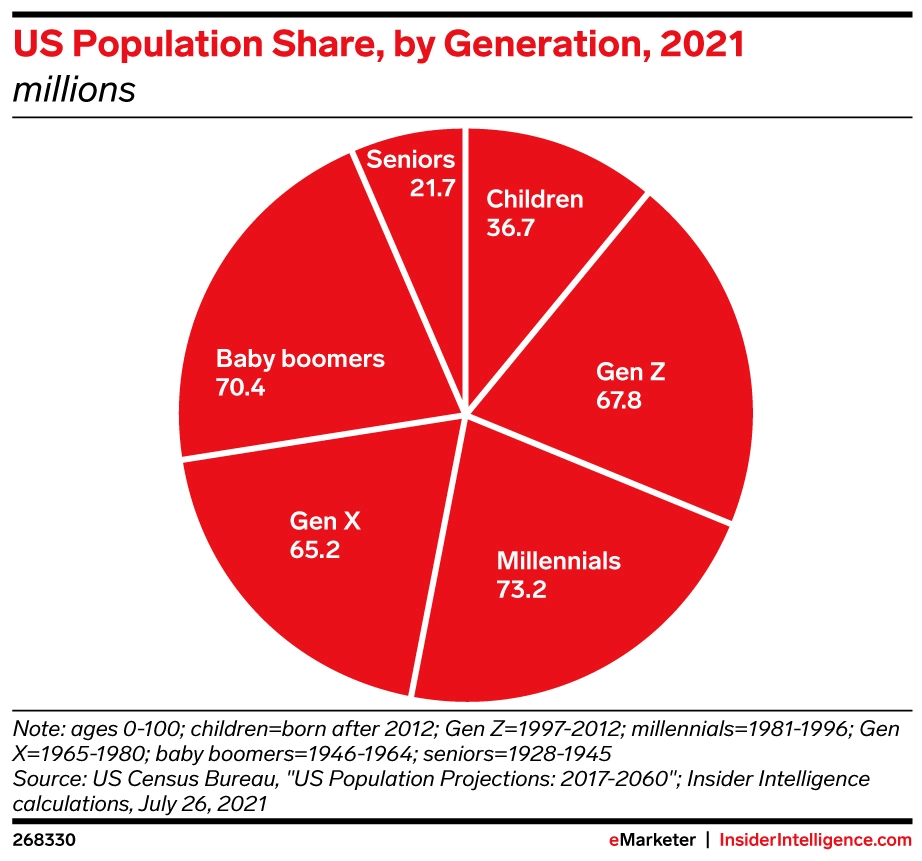

In China and the USA, there are an estimated 423 million millennials. This is a huge target audience. But what is more, it is a relevant target audience for fintech marketing.

- In 2016, 35% of the US workforce were Millennials. But by 2025, this age range will make up 75% of the global workforce. This means millennials will become the most prominent and wealthy potential customers of fintech companies in the near future.

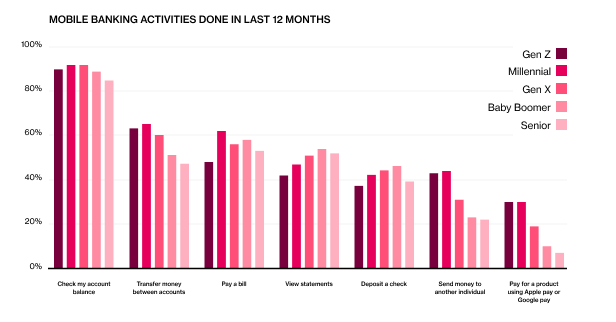

- 94% of millennials use a banking app to do basic financial tasks, from viewing their account to moving funds. While 24% stated, they would use online banking services such as investments and insurance.

- Traditional banks are seen as unneeded. 37% of Millennials would instead use fintech companies. Only 28% would prefer to use a traditional bank. In fact, 73% of Millennials would be more excited about a new financial service from the likes of Amazon or Apple than a standard bank firm.

- The trust in both fintech and traditional finance is now almost level. Overall confidence in fintech is at 75%. While more conventional establishments are at 79%. In fact, 33% of those asked believe that the need for a bank will no longer exist within the next five years.

So, Millennials are ready for customer acquisition. They want a startup to redefine finance. And the best way to show them that your FinTech startup is the answer to their prayers is a concrete marketing plan.

5 Inspirational Fintech Marketing Examples

FinTech marketing campaign aims to reach new potential customers and create organic SEO. Even if your app can answer countless customer pain points, a solid content marketing strategy must be in place to reach these new customers.

But the Millennial audience can seem hard to impress. The tried and tested means of ad campaigns and email marketing do not cut it with Millennials. But don’t worry; your marketing efforts are not for naught. With the next few examples, you will see some creative marketing techniques that will give your fintech business an advantage in this crowded market.

1. Monobank and gamification

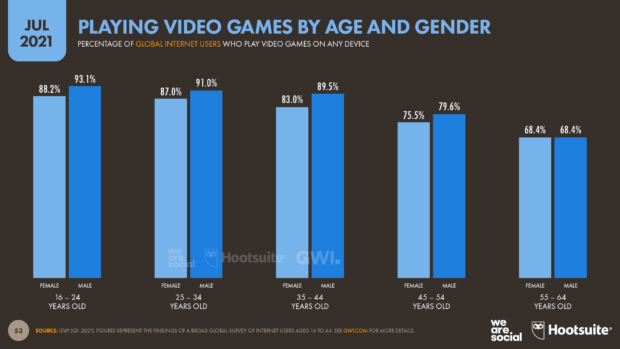

77% or more of Millenials play video games. That is a lot. Millennials spend more time gaming than using any other form of entertainment. This includes social media, television, and music. It may seem obvious why some fintech companies have started using gamification in their digital marketing to lure in the gaming generation.

On the outside, Monobank appears like a standard online bank. And to some extent, it is. Founded in 2017 as Ukraine’s first mobile bank, Monobank has one clear message. Banking can be fun.

Yeah, banking is not the most enjoyable experience. But Monobank has strived to change that by using gamification. The idea of bringing relevant content to their consumer by providing an engaging user experience is at the core of Monobank’s philosophy.

Their cute, fun, and quirky animated mascot, QR cat, is proof of this. This idea is also seen in the many functions of the app. For instance, there is Shake to Pay. Forget the routine slog of a bank transfer. Monobank has introduced a system where two users can simply shake their phones to activate a transaction.

There are also many reward badges. These badges are earned through numerous financial challenges, from splitting a bill to spending money in other countries. These are not complex tasks. But, completing these goals still provides a sense of satisfaction for the user.

It just proves that a gamification initiative can be simple. You don’t need to create the next Super Mario Bros to have a good marketing strategy. Just take the time to create a fun user experience that encourages an element of play.

Here is a list of a few possible simple gamification ideas any fintech company could use:

- Rewards, stickers, badges, or points

- Progress bars

- Educational quizzes

- High-score leaderboards

- Saving goals

- Referral rewards

- Mini games

For instance, take Monobank’s sports deposit account. Never heard of it? We don’t blame you. It isn’t exactly standard banking. Monobank awarded a 21% rate on savings to users who walked a total of 10,000 steps a day. Any consumer who did not achieve this three days in a row was given a lower rate.

The co-founder of Monobank, Oleg Gorokhovskyi, admitted that the deposits made to these accounts were low. But, the news and public reaction were ‘a big hit’ for them.

While this strategy was not financially successful, it did prove a great marketing ploy. It improved customer retention, brand awareness, and customer acquisition due to the positive press. In 2021, Monobank’s 3.5 million core user base had 1.3 million daily active users and 100,000 new customers a month.

These incredible metrics do not lie. Gamification is a fantastic marketing technique to seek out new Millennial customers via interactive tech. So, it could be time for your fintech company to look towards gamification to level up your digital marketing.

2. Betterment and Influencer marketing

The idea of using the power of the influencer to market financial institutions has been around for decades. Take these 90s adverts for Barclays that featured British comedian Rowan Atkinson as an MI7 agent.

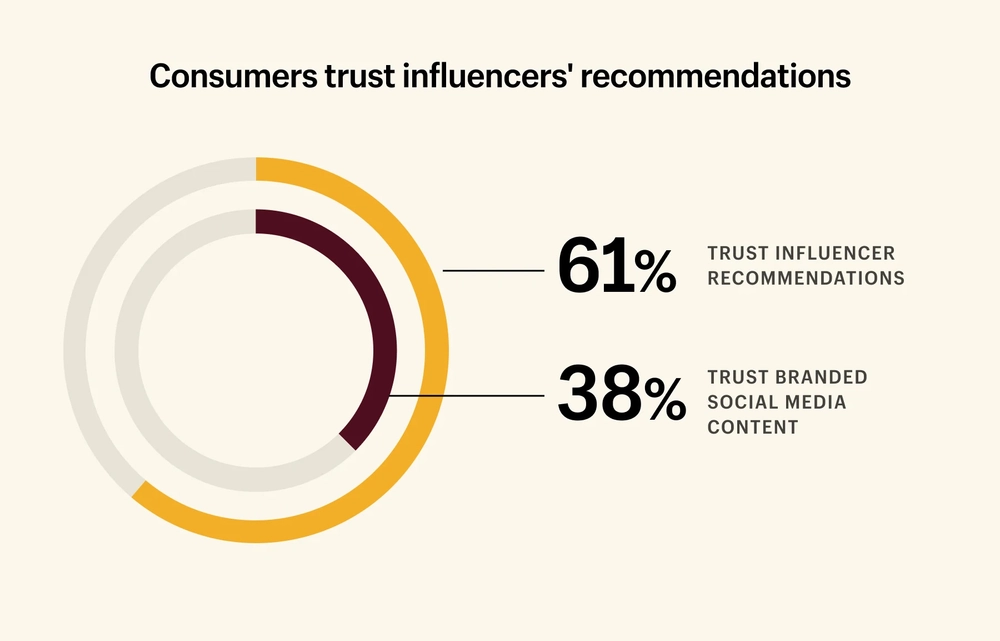

It did not take long for the fintech industry to follow suit. Using influencers as a referral system for new customers is incredibly valuable. And here are some statistics to prove it.

- Influencer marketing has been used by 93% of marketers.

- Over 61% of customers trust recommendations from influencers.

- 4 out of 10 Millennials believe that influencers understand them better than their friends.

8 out of 10 users have purchased a product based on an influencer’s recommendation.

Klarna is the industry expert in this field. Their iconic ‘Smoooth’ campaign featuring Snoop Dogg was an incredible success at building a recognizable brand.

However, the idea of using a ‘finfluencer’- a finance influencer- instead of a celebrity has become popular in marketing. Rather than using celebrity power, some fintech brands use financial experts to promote their brand with incredible success. After all, we doubt Snoop Dogg really knows a great deal about finance.

Let’s take a peek at another fintech company’s influencer marketing efforts. Betterment is a fintech company that understands the benefits of finfluencer marketing. It had invested a lot of money in using Billion’s TV star Maggie Siff in commercials to moderate success.

But, the real growth was yet to come. Austin Hankwitz took to TikTok to announce his plan to retire as a millionaire using Betterment to his 500,000 followers. Betterment recorded 10,000 new registrations in response to Hankwitz’s glowing referral in a single day.

Arielle Sobel, Betterment’s Head of PR, stated that they see great metrics in response to their use of influencers. He believes this is because they can simplify complex financial ideas for their followers.

Betterment now has an entire section of its website dedicated to financial education. It has a resource library full of articles by financial experts. These resources are incredibly enticing for the Millennial generation as they become the biggest demographic in the workforce.

You no longer need to fork out a fortune to start an influencer partnership. Hiring a finance expert to promote your fintech startup with valuable content is much more practical and cost-effective.

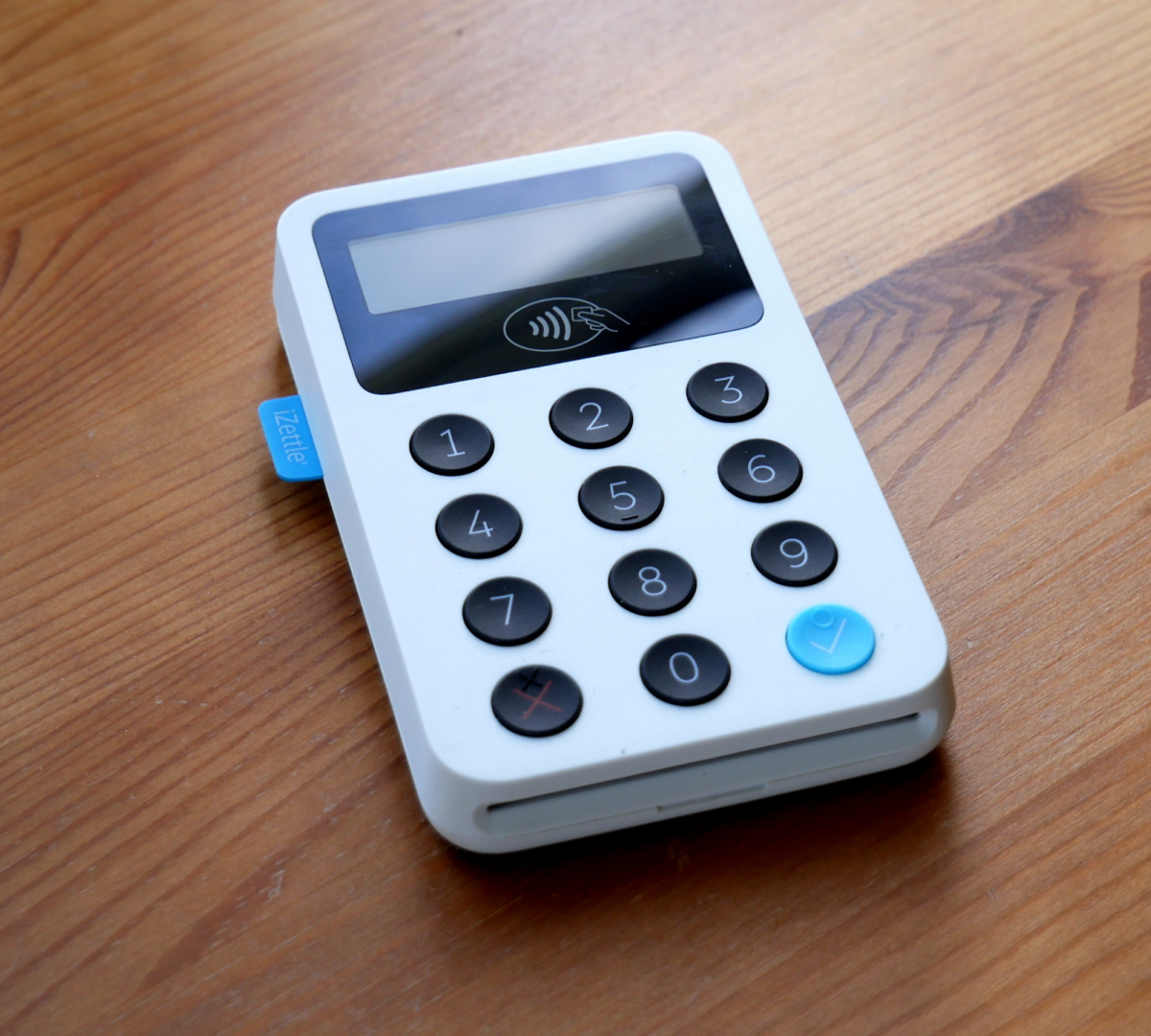

3. Zettle and experiential marketing

Have you ever heard of experiential marketing? If you haven’t, you need to. It is all about creating an experience to produce brand awareness.

Zettle was a mobile card payment processing service that wanted to make a splash in the UK. So, in 2012 they hosted a pop-up market. They invited a few small businesses to trade at their event, taking tablet and mobile payments through Zettle.

This event was a real-life demonstration of their new product in action. The target audience could directly give feedback on their favorable experiences with this fintech. There was no better way to show their brand’s value to the journalists and industry experts in attendance.

And, yes, this PR stunt created a lot of buzz about the product. There were 80 articles published about Zettle from the likes of BBC News Online and The Financial Times. This word-of-mouth marketing saw Zettle secure a 425% increase in sales and a massive uplift in website traffic for the brand.

Additionally, experiential marketing is relatively cheap compared to traditional marketing techniques. Zettle’s stunt had a mere £25,000 budget to deliver this successful event.

So, could experiential marketing be the missing ingredient in your fintech marketing strategy? If the answer is yes, then the next step is obvious. First, consider what is your value proposition for your target audience. Then start planning an incredible event that showcases this.

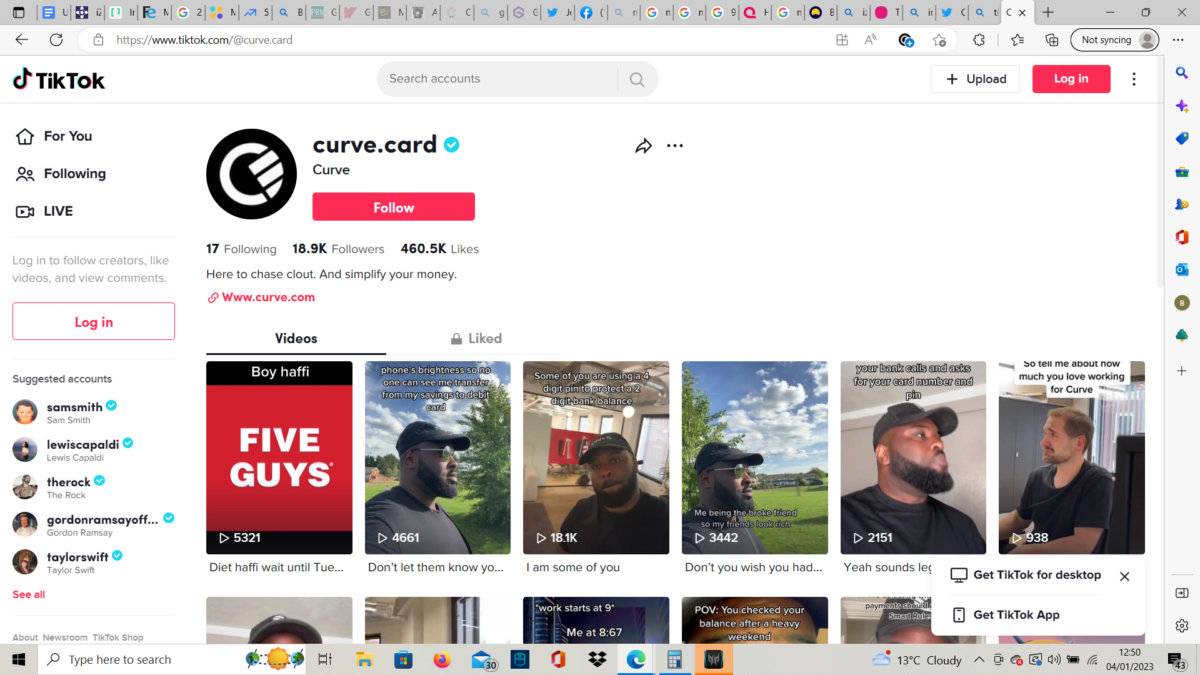

4. Curve and social media marketing

You need to know where your target audience spends most of their time to create the best touchpoints. Millennials make up 37% of social media users. This makes them the largest audience on these platforms. It is no wonder why so many brands have targeted social media to capture the attention of this audience.

The fintech startup Curve is everywhere. They have a presence on almost every social media platform, from Linkedin to TikTok.

| Social media platform | No. of Curve followers |

| 23.7k | |

| TikTok | 18.9k |

| 47.1k | |

| 28.3k | |

| 26.9k |

Curve is incredibly visible to its target audience, and its content is aimed towards them. The formal tone of traditional banking is replaced by a playful, fun, energetic style tailored for this new demographic. The main message conveyed here is that fintech is more human, approachable, and engaging than its traditional counterparts.

Katie Rosseau, Curve’s Creative Director, said:

Our goal is to make branded social media suck less. Curve is here to disrupt the world of finance, so why wouldn’t our tweets do the same?”

This statement shines through in their content. Their TikTok is full of hilarious, fun, yet relevant short videos. Curve’s social media accounts are full of memes, gifs, and posts designed to promote consumer engagement and their brand.

Social media marketing is essential in trying to gain the attention of Millennial customers as this is where they mainly spend their time. But, Millennials also desire fun and engaging content rather than formal, bland prose.

So, start creating social media content for your fintech brand. Dance to the newest TikTok craze, post funny yet informative posts or make an informative podcast. Whether you deal in cryptocurrency or banking, go ahead and optimize your social media content for Millennials; you won’t regret it.

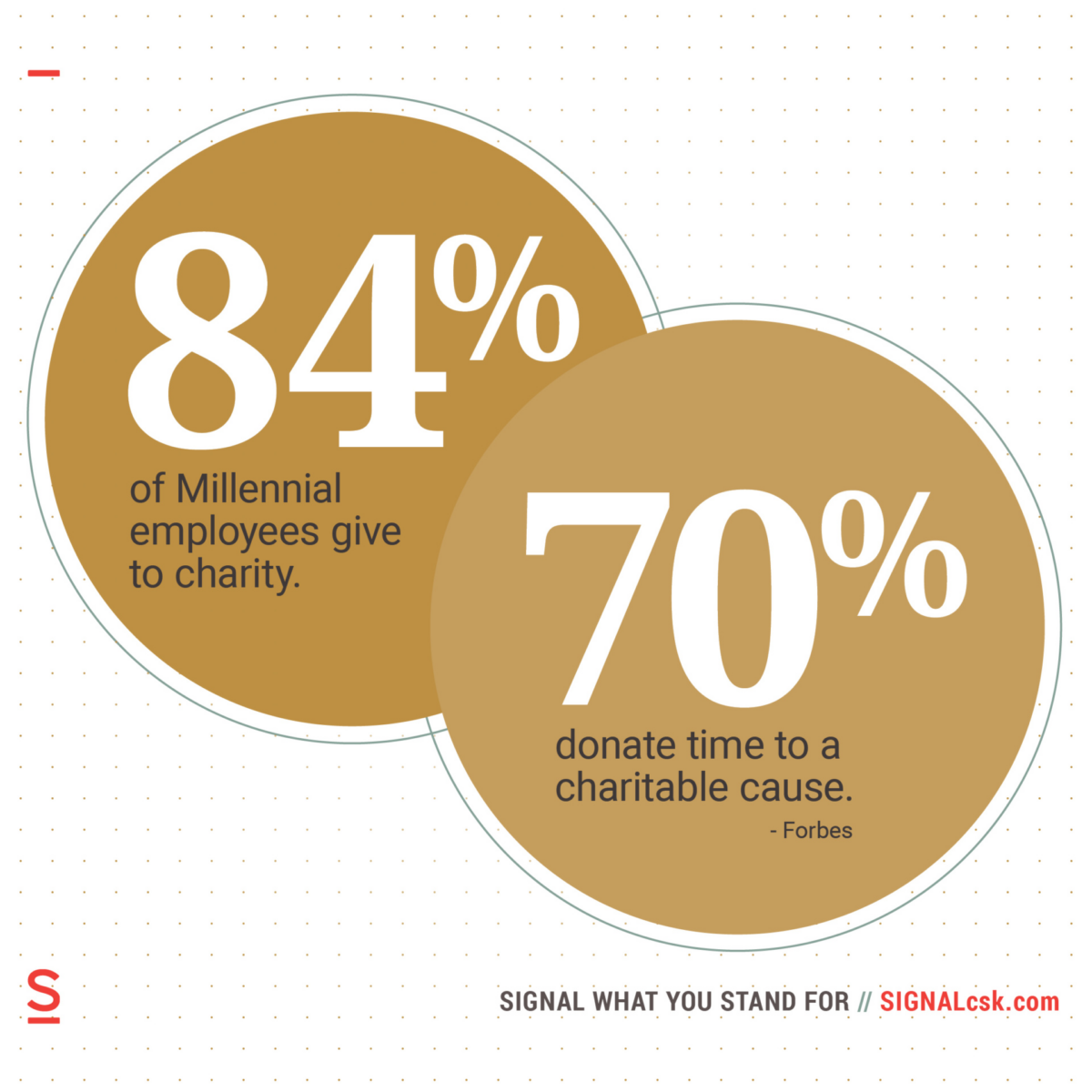

5. GoodBox and charitable causes

This might be surprising to some, but Millennials are the most charitable generation. It is estimated that 84% of Millennials annually make charitable donations,. While 70% volunteer for what they consider to be worthwhile causes. It will be no surprise that 75% of Millennials look for brands supporting charitable causes they believe in.

So, charity seems to be important to the Millennial audience. Therefore, it would be logical to promote any charitable work that a brand does to reach this demographic. This can be seen with countless fintech companies. The building society Nationwide has an entire page entitled ‘supporting charities’. Here it lists the numerous charitable achievements of the brand.

GoodBox is no exception. GoodBox has created a solution for charity organizers in a world where no one carries cash. They have created digital charity boxes making contactless donations a possibility. Currently, 700 charities have used GoodBox to raise over £2 million in donations.

Their social media feeds are packed with case studies of charitable organizations they have supported. For instance, their Twitter feed features tweets about GoodBox payment machines being used by charities that range from The Stroke Association to local parish fundraisers.

Now, this does not only encourage positive brand awareness due to the company’s charitable nature. It also allows potential new customers in the charity sector to see the numerous benefits of this brand on other charities.

Showcasing your brand’s charity work is a fantastic way to produce positive brand awareness and entice new customers. So, what are you waiting for? Head to social media now and shout about the charitable work that your brand is doing.

Conclusion

What have we learned from our look at these 5 inspirational Fintech marketing examples? First, we realized why the Millennial demographic is the most craved target audience for so many fintech companies. This can be broken down into three main factors:

- They make up the most significant percentage of the workforce.

- Millennials are much more inclined to interact with fintech.

- This generation has a much more positive opinion about fintech.

We then examined five fintech marketing examples that used diverse techniques to raise brand awareness.

- Monobank used gamification to create a fun, addictive platform that was a fantastic means of marketing for a gaming-obsessed generation.

- Betterment used finfluencers instead of traditional influencer marketing to target audiences with relevant content.

- iZettle hosted a pop-up market to demonstrate their product’s numerous benefits.

- Curve reached out to Millennials on all social media platforms with a unique message.

- GoodBox shouted about their charitable causes to gain positive brand awareness.

With all this in mind, don’t always go the traditional route when building a fintech marketing strategy. It is much better to be innovative and creative, especially in an industry built on these concepts. Take these incredible fintech marketing examples as inspiration and create new, exciting ways of reaching the Millennial audience.