Launching a financial technology (fintech) startup is an exciting adventure, but there’s some tricky terrain you’ll have to navigate. There are about 30,000 fintech startups out there right now, but statistically speaking, 90% of them will fail.

Fintech entrepreneurs face challenges like regulatory hurdles, fierce competition, and the constant need to innovate. However, don’t lose hope yet. Software as a Service (SaaS) companies have cracked the code to ensure long-term, successful growth that will prevent you from becoming another victim of the harsh startup world.

In this article, we will show you how using SaaS companies will do wonders with growing your fintech startup into a powerhouse ready for anything.

The role of SaaS in fintech

Without SaaS, an action as simple as buying a coffee becomes much more complicated. The process would involve fumbling for cash or swiping a physical credit card, waiting for a printed receipt, and manually tracking your expenses later.

It’s time-consuming, easy to make mistakes, and lacks the efficiency we’ve grown so used to in the modern world. This is just one instance; in reality, SaaS is the backbone behind fintech if you have a closer look at the following aspect..

Simplifying complex tasks

It’s probably not surprising to hear that there are a lot of technical obstacles in fintech. Whether managing complicated processes or staying within meticulous guidelines, it can take the wind out of even the smartest people’s sails.

But SaaS isn’t phased and makes seemingly unthinkable ideas possible for those who never would have imagined it. You get pre-built, scalable tools that cover a huge range of functions like:

- Data analytics: Simplifies data analytics by turning complicated financial data into clear, useful insights.

- Risk assessment: Acts as a guide through complex regulations, helping fintech companies stay compliant and on track.

- Payment processing: Managing payments, even worldwide, with ready-made tools and shortcuts to handle different payment methods.

Creating a reality where the brightest minds are no longer held back by technical hurdles is exciting and crushes the barriers that once confined fintech to a select few. Now, innovative leaders from various financial institutions are using SaaS-powered platforms to benefit not only themselves but society as a whole.

Working smarter, not harder

You can waste lots of time being bogged down with repeated mistakes and manual processes that really hold your fintech startup back. It may be traditional to have endless piles of paperwork on your desk, but with SaaS, you can break free from these old ways and embrace a new era of efficiency.

Think about how many hours you’ve spent on data entry, going over spreadsheets, and fixing preventable mistakes. It’s not just time-consuming; it’s frustrating and unproductive, which makes the already challenging aspect of running a fintech company harder.

As well as this, SaaS enhances the customer experience by creating seamless onboarding processes and optimized support services. When your customers experience this level of efficiency and service, it’s a win-win.

They get what they need quickly, and you get to focus on growing your fintech startup and exploring new horizons, unburdened by the boring stuff. Honestly, wouldn’t you rather experiment with logo ideas instead of filling out forms?

Following rules and guidelines

As we mentioned, there are a lot of rules when it comes to fintech, and for good reason. The financial industry is built on trust, and ensuring you maintain the right standards is how you ensure this. Regulations change, and they change often. A reliable SaaS company will keep you updated about these developments and update their software to keep you on the right side of the law.

To avoid any data breaches or hacks, SaaS companies have dependable data security. This is very important as customers trust you with their data. It’s a big deal. So, encryption, access controls, and safe storage are essential but often too hard to properly implement without SaaS.

And speaking of trust, it’s not just about following the rules; it’s about building a reputation that customers can rely on. When you work hand in hand with a SaaS provider who’s got your back on compliance and data security, you’re sending a strong message to your customers that they can fully trust you with their personal finances.

What advantages does SaaS offer to fintech startups?

All of which we’ve covered already in terms of how SaaS is used in fintech only explains so much. Let’s cut to the chase and delve deeper into the specific reasons why you, as a fintech startup, should seriously consider using a SaaS company.

Cost-effective growth

Traditional software development is very expensive. You need to hire the right tech pros to build it from scratch and then keep up with its maintenance. This can easily suck up all your budget as a fresh-faced startup.

However, with SaaS, instead of starting from the bottom, you are given ready-made software ready to go whenever you are. You pay for what you use without those big upfront costs or the headaches of keeping things running smoothly.

As well as this, when your fintech startup expands, you can easily scale your software usage – no need to buy more than you need. SaaS often includes updates and maintenance in the package, saving you the trouble and cost of hiring an IT team.

Everything is faster

The financial industry evolves quickly, with new technologies and customer demands piping up constantly. Conventional software development, while thorough and reliable, often takes a long time to come to fruition when the finished product is finally released to the market.

SaaS provides you with pre-built, ready-to-use tools that are designed specifically for the fintech industry. You don’t have to spend ages creating every feature from scratch. Instead, you can hit the ground running, reducing the time it takes to develop and launch your financial products or services.

The real advantage here is that SaaS allows you to be agile, outpace your competitors, and, most importantly, roll out new features or services precisely when they’re most relevant to your audience.

Experts at your fingertips

SaaS companies that specialize in fintech have a bunch of experts ready to help. They’re experienced in the industry’s quirks and have a thorough understanding of how things work, including:

- Software: Create and maintain the software that is the foundation of your financial services. Their job is to make the software run smoothly, efficiently, and ready to adapt to new challenges.

- Data security: Protect your users’ sensitive information with encryption, access controls, and other high-tech tools to protect data from cyber threats.

- Market research: Help you understand competitors, emerging market trends, and what your customers are looking for. This allows you to make properly informed decisions.

- User experience: Make your financial technology company easy and enjoyable for users. Elements such as user interfaces and workflows are optimized to streamline the experience for everyone.

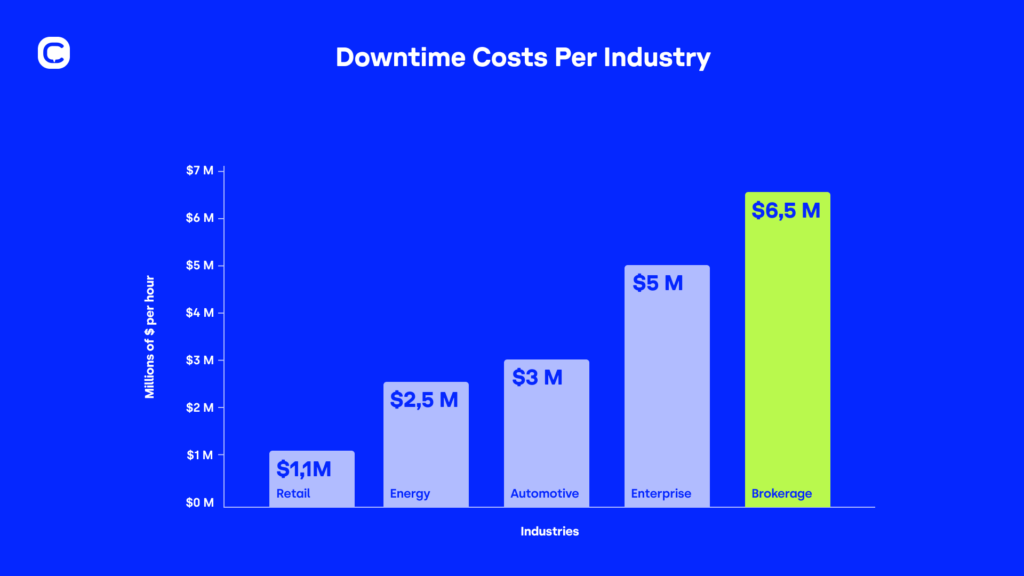

Bounce back from setbacks

Fintech services need to keep running smoothly, no matter what. SaaS companies understand this and provide robust disaster recovery to keep the business performing at its best. This safety net allows the digital ecosystem you’ve lovingly designed to continue rolling as if nothing happened while the pros see to issues in real-time.

Examples of fintech companies using SaaS

Many fintech companies rely on SaaS solutions to power their operations, helping them grow, work more efficiently, and provide better user experiences.

Stripe

Stripe is a widely recognized American company that provides:

- Payment Processing: Offers a secure and efficient payment processing system crucial for handling cash flow between lenders and borrowers.

- Streamlining invoices: Helps streamline the billing process for fintech platforms using automation to make things efficient and user-friendly.

- Digital asset management: Fintech startups can efficiently handle assets like digital downloads by simplifying the process of managing and processing them within their platforms.

Fintech startups can integrate Stripe‘s services into their online platforms to handle invoices, subscriptions, and more. It makes accepting payments much easier and ensures a smooth experience for businesses and their customers.

Plum

Plum is an artificial intelligence (AI) driven platform that uses machine learning algorithms and automation to provide savings and investment management to customers. Plum looks at your spending habits and automatically sets aside a few dollars for personalized goals. This makes it easier to save money without feeling too restricted.

Chime

Chime is a neobank specializing in mobile banking with a range of financial services thanks to its SaaS platform. Fintech startups can use Chime‘s technology to provide banking services, including checking and savings accounts, to customers without a hefty traditional banking framework.

Plaid

Startups can use San Francisco-based Plaid for services to enable features like account linking, transaction categorization, and identity valuation, improving the functionality of their payment platforms.

Users can link their bank accounts to financial apps without worrying about security issues which is particularly great for big purchases in real estate and valuable asset management. It also makes it easier for homeowners and renters to set up automated mortgage or rent payments.

Revolut

London-based Revolut offers a range of financial services through the mobile app, including:

- Multi-currency digital banking

- International money transfers

- Budgeting tools

- Physical debit card

Also, while Revolut is not solely a blockchain company, it offers cryptocurrency-related features within its management platform, including the ability to buy, sell, and hold crypto like Bitcoin and Ethereum.

Fintech startups can integrate with Revolut‘s API to give their users a huge selection of payment solutions. It simplifies international transactions while making the banking experience feel modern and sleek.

Stash

Stash is a fintech platform founded in New York, offering mobile banking, investment services, and information from financial advisors. You can also use educational resources, improve your credit score, and make automated investments.

Choosing the right SaaS company as a fintech startup

Deciding on the perfect SaaS company is a big step for any fintech startup, and it involves weighing multiple factors to make the right choice.

Experience speaks volumes

When looking for the right SaaS company, experience is everything. They should know the fintech landscape like the back of their hand and have a squeaky clean track record of helping fintech startups.

Explore the LinkedIn profiles of their team members. It can reveal their professional backgrounds and expertise. If you’re still looking for more information, don’t be shy about reaching out to the SaaS company directly.

Make a list of questions about their experience, past projects, and how they can specifically help your fintech startup.

Think about size

When considering the size of a SaaS company, look into the specifics. Larger tech companies often have more resources, including bigger teams, cutting-edge technology, and an established reputation and image. This can be particularly beneficial for fintech startups with ambitious plans and the budget to back it up.

On the other hand, smaller SaaS companies can offer a more intimate partnership. With a smaller team, you may have a more personalized touch, direct access to experts, and a collaborative approach that meets your unique needs. If you value agility, flexibility, and a hands-on approach, a smaller SaaS partner might be the right fit.

Ultimately, the size you go for should fit with your goals, size, and preferred way of working. It’s not just about big versus small; it’s about what complements your vision for success.

Support and communication

It sounds intense, but open and transparent communication goes beyond the usual 9-to-5. It means having a support team there for you round the clock, 24/7. This isn’t to be demanding, but it is in fact essential for staying on top of things – fintech never sleeps and can be totally different when you log on in the morning.

Whether you encounter a technical mishap in the middle of the night or need help during a big market shift, your SaaS company should be a call or message away, ready to ease your concerns.

Compatibility check

In this partnership, it’s not just about how well you work together; it’s about how well you understand, respect, and complement each other’s brand, values, and visions for the future.

The fintech industry is about long-term impacts, not quick fixes. Your SaaS partner should be on board for the long haul, just as you are.

Cost considerations

While cost isn’t the only factor, it’s undoubtedly important. Striking the right balance between cost and value is a key element of being financially responsible, something all startups should be.

While considering cost, it’s important to break down what you get for your money. A company may have a slightly higher upfront cost, but if they offer a big selection of services, including maintenance, updates, and support, it could save you money in the long run.

Additionally, it’s essential to consider how much you intend to grow and at what rate. SaaS partners should have a pricing model that can adapt to the changing needs without emptying your bank account, which is fatal for small businesses trying to make it big.

Potential drawbacks of using SaaS companies as a fintech startup

Alright, so we’ve been talking about how SaaS can be a game-changer for fintech startups. But let’s not sugarcoat it – there are some things you need to know, the not-so-glamorous side of the story. So, here’s what to watch out for:

You’re in their hands

When you get SaaS involved, you put your trust in someone else’s hands. If the company faces issues or, in a worst-case scenario, goes out of business, your fintech services could pay the price. Choose your SaaS partner wisely and have a backup plan just in case, even if the match was seemingly perfect to begin with.

Hidden costs

At first glance, the pricing may appear straightforward, but as you dive deeper into the fine print, you may uncover additional charges that can catch you off guard. Here’s a closer look at some of these hidden costs:

- Data storage: While SaaS often offers bigger storage solutions, there can be a cost associated with exceeding certain limits. It’s like renting a storage unit; you might start with a small one, but as you get more stuff, you’ll need to move up to a larger, pricier unit.

- Additional features: Your SaaS provider may offer various add-ons, features, or plugins to enhance the functionality of your software. These can be appealing, but they come at an additional price.

- Training and onboarding: While many SaaS platforms provide self-service onboarding, some businesses may require more extensive training. If your team needs extra guidance, you might have to pay for training sessions or specialized onboarding.

Before committing to a SaaS solution, carefully look over the terms and conditions. Pay attention to any mentions of additional fees and conditions for extra services. Also, keep a close eye on your usage patterns to ensure you stay within the limits of the subscription and avoid extra charges.

Data security risks

We’ve talked about how vital data security is, but remember, when you hand over your sensitive financial data to a third party, there’s a level of risk involved, no matter how robust their protocols are.

Let SaaS clear the way ahead

As a fintech startup, you’re only holding yourself back by not embracing the power of SaaS. Surely you want to grow faster, have experienced professionals at your aid, and keep customer data safe? Of course you do; that’s why you need SaaS on your side.

However, SaaS companies can handle more than just wealth management. They can also help industries like healthcare, fundraising, and e-commerce. So whatever field you’re in, there is a SaaS company waiting to take you to the next level.