Fintech companies fulfill a vital role in many people’s lives — from platforms like Chipper Cash, which makes digital banking accessible to unbanked people throughout Africa, to currency conversion services like Wise, which facilitates transactions in multiple currencies without exorbitant fees.

On the business side of things, fintech platforms solve a number of problems — from simplifying cross-border transactions like Payoneer to providing access to financing solutions like Stenn and improving processes from accounting to data management to customer service.

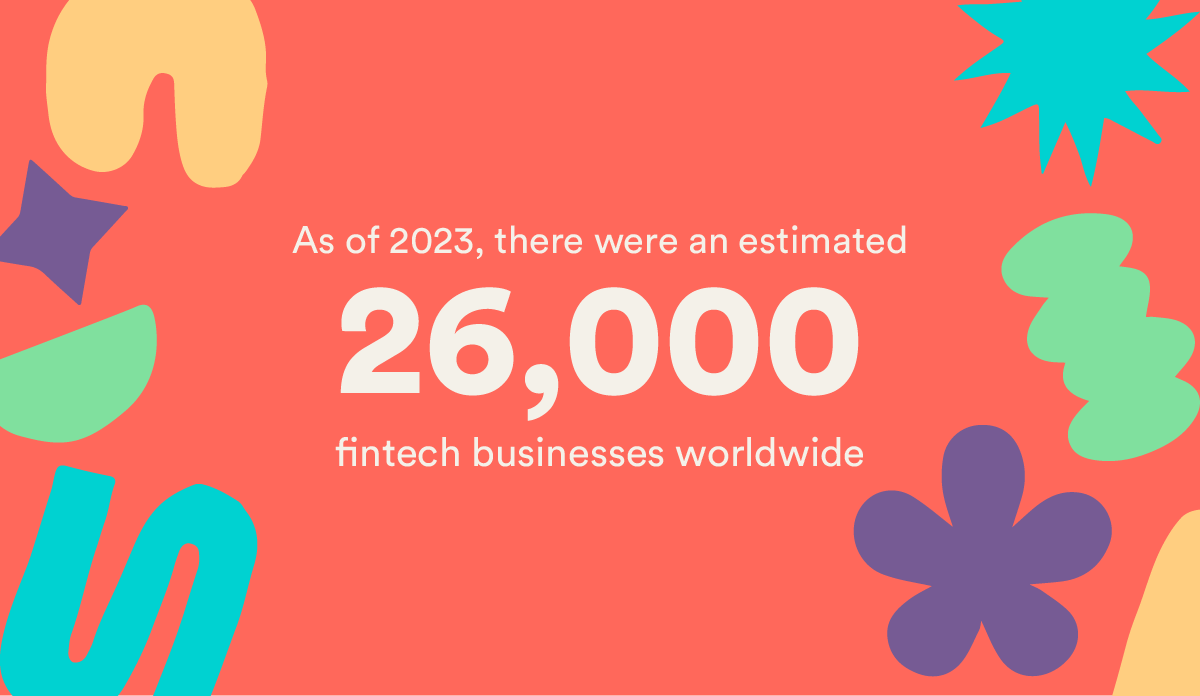

The average consumer uses three to four fintech apps to manage their financial life, and 96 percent of global consumers are aware of at least one fintech service or company, so it’s no surprise that as of 2023, there were an estimated 26,000 fintech businesses worldwide.

With so many companies vying for a piece of the fintech pie in 2024, a solid marketing strategy is essential — particularly when you consider the high cost of customer acquisition, which averages $1,450 for fintechs.

Read on to learn how to design and execute a fintech marketing strategy that will help your business grow in 2024.

1. Focus on financial literacy and education

Although financial literacy is an essential life skill, few people receive a robust financial education at school — and it’s costing them money. A jaw-dropping 15 percent of consumers say that a lack of financial literacy has cost them $10,000 or more, and Gen Z is the demographic lagging furthest behind.

Only 36 percent of them score 51-100% on financial literacy tests, compared to 48 percent of Millennials, 48 percent of Gen X, and 59 percent of Baby Boomers. Therefore, focusing your marketing efforts on financial education rather than selling products is a great way to build trust among your target audience and establish your credibility as an industry leader.

Some ways to incorporate financial literacy into your marketing strategy include:

- Create a robust content marketing strategy with educational content that addresses financial literacy gaps through informative resources like blog posts, videos, and webinars. Personal finance fintech Mint does a great job of this through its blog, which is written by financial experts and provides advice on topics ranging from budgeting to money etiquette.

- Leverage influencer marketing by partnering with financial educators and influencers to reach a wider audience and deliver valuable content — like Ramit Sethi, a personal finance blogger known for providing advice that allows individuals to live their “rich life.” If Gen Z is your target audience, consider reaching out to TikTok influencers like @thisgirltalksmoney.

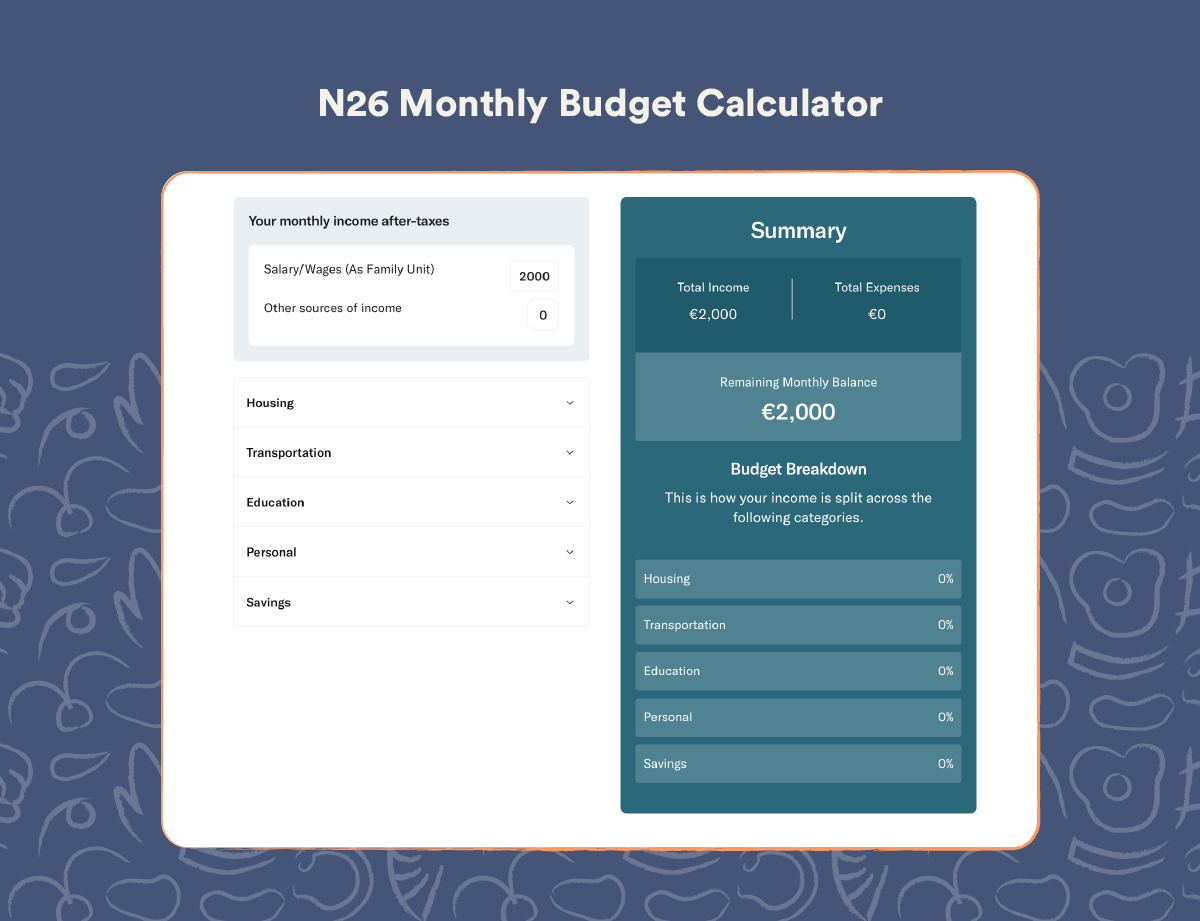

- Provide interactive tools that help users make informed financial decisions, such as calculators. For instance, digital bank N26 offers a handy monthly budget calculator on its website.

Design a fintech-focused SEO strategy that provides valuable, actionable answers to the questions your target audience is searching for on Google.

2. Embrace experiential marketing

Experiential marketing is a broad term that covers a wide range of participatory marketing experiences, enabling brands to connect with their customers in a more personal way. It can range from virtual events like webinars and live Q&A to pop-up stores and in-person events.

The aim of experiential marketing is to encourage engagement and promote desired actions through interactive elements and gamified experiences. For example, when Swedish fintech startup Zettle launched in the UK, it hosted an in-person pop-up market where businesses tested the product by accepting payments on tablets and smartphones and provided feedback on its features.

Some experiential marketing examples to experiment with include:

- Creating immersive and interactive experiences with events, workshops, and webinars to engage your audience and build relationships.

Using virtual reality (VR) and augmented reality (AR) technologies to offer customers an innovative way to experience your products and services. For instance, Mastercard partnered with Wearability to create an immersive AR experience where users could purchase golf gear directly through their AR headset.

- Developing branded mobile apps or games that both entertain and educate users about your financial services, enhancing brand recall and engagement. For example, a fintech company specializing in savings could create an app-based game that rewards users for achieving personal finance goals.

- Hosting challenge or competition-based events that align with your brand’s ethos and offerings. For instance, a fintech firm focused on investments might host a virtual stock market challenge, offering participants a simulated trading experience with prizes for top performers.

- Implementing interactive installations in high-traffic areas, like shopping malls or city centers, where people can engage with your technology in a fun, hands-on way. This could include touch-screen kiosks for easy app demos or interactive digital walls that visually explain your fintech services.

3. Emphasize security and privacy

While the digitization of financial services brings with it ease and convenience, it also carries inherent security risks since it requires fintech companies to store and use highly sensitive personal information.

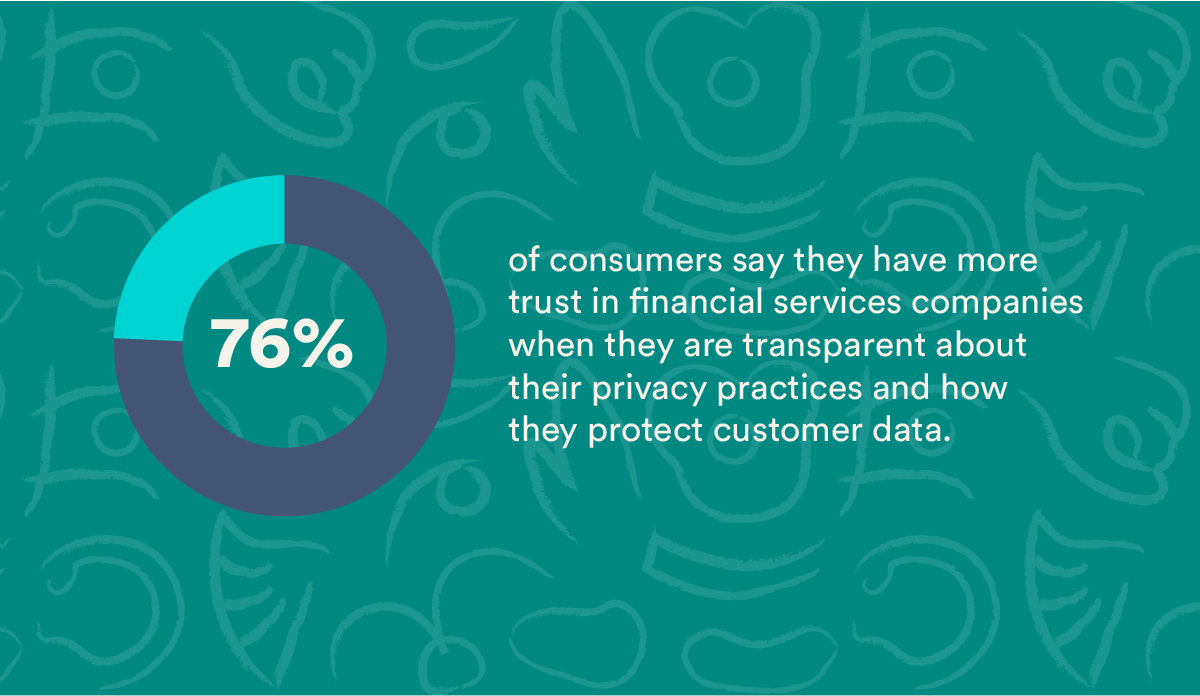

Therefore, data privacy is a huge concern for both individual users and businesses that rely on fintech services: 76 percent of consumers say they have more trust in financial services companies when they are transparent about their privacy practices and how they protect customer data.

But they don’t just want transparency — nine out of ten fintech users want more control over how their data is used, with 83 percent preferring to choose where their information is shared.

These concerns are legitimate, as banks and financial service providers are frequently the targets of cyber attacks — notable cases in recent years include Paypal, Stripe, Capital One, Bank of America, Citibank, and many more.

Therefore, it’s essential to comply with relevant data privacy regulations and offer strong authentication methods and data protection features. This will demonstrate your commitment to protecting user data and help ensure user information is safe and secure.

Incorporate privacy and security into your marketing strategy by clearly communicating your data security measures and privacy policies to build trust and transparency with your customers.

4. Highlight your social impact

As concerns around climate change and social issues like inequality grow, a growing number of consumers want to support ethical brands that align with their values. This is particularly important among Millennials and Gen Z, who are willing to pay more for products and services that demonstrate a commitment to social and environmental responsibility.

The fintech space is no exception, with 67 percent of consumers agreeing that they want their bank to be more sustainable. One way to do this is to offer sustainable financial products and services that cater to the growing demand for eco-conscious financial solutions, like Treecard, a debit card provider that partnered with Ecosia to plant trees for every transaction made.

If sustainability isn’t baked into your business (yet), don’t worry — there’s still plenty you can do, such as highlighting any social or environmental causes your brand supports by integrating them into your marketing messages.

Consider using partnership marketing to partner with organizations that share your values — such as nonprofits and social impact initiatives — to amplify your message. Partnership marketing means forming collaborative relationships that benefit both organizations and help achieve their goals.

5. Leverage omnichannel marketing

Despite the slightly ominous-sounding name, omnichannel marketing is an essential strategy for any fintech brand, helping to create a seamless user experience across all platforms. This can strengthen your brand image and raise brand awareness among potential customers.

Channels to consider using in your marketing strategy include:

-

- Social media and mobile marketing — over 60 percent of consumers want to access fintech services and complete transactions through a single platform, such as social media or mobile apps, making them the perfect home for your marketing messages.

- Audio marketing — audio ads, such as streaming and podcast ads, are an effective way to reach engaged audiences with personalized messaging, particularly for Millennial and Gen Z audiences, who are the biggest consumers of audio content — one in five of them listen to Spotify while using the internet. Additionally, people now spend more time listening to audio content on their mobile devices than social, video, and gaming, making it one of the most powerful marketing channels.

- Video marketing — despite audio’s rising star, video isn’t going away anytime soon, and YouTube is still the world’s second most-used search engine after Google, so it’s an ideal platform for fintech video content. Fintech companies should focus on content such as explainer videos and how-tos that provide value for your target market — like this video by Klarna, which explains how e-commerce businesses can monitor and fine-tune their strategies.

- Digital out-of-home (DOOH) — DOOH refers to the interactive digital billboards and posters that you may have spotted in places such as bus or train stations. The advantage of this medium is that it takes your marketing off your audience’s screens and out into the real world — like Apple’s 2023 campaign “Pay the Apple Way,” which rolled out DOOH ads across the US and UK to highlight the hassle-free nature of its fintech offerings. Additionally, programmatic DOOH providers like Grapeseed Media can help you optimize campaigns in real-time for maximum impact.

Your omnichannel strategy should create a seamless customer journey across all touchpoints to ensure consistency in messaging and branding across all channels. It’s essential to leverage campaign data to optimize performance by doubling down on the channels and formats that yield the best results.

6. Use community marketing

Community marketing is exactly what it sounds like — leaning into the innate human need to feel a sense of belonging and creating a community of people with similar values, interests, and concerns. This is a powerful marketing tactic that can position your brand as a trusted friend and make your followers feel included in the journey.

There are many different ways to achieve this — a popular strategy among fintech companies is through crowdfunding campaigns that offer supporters exclusive perks and benefits, such as early access to a new app or features, which is exactly what Revolut did in its early days.

Other community-building techniques include asking for feedback on current offerings and how to improve them, community meet-ups, live Q&As, and suggesting names for future products. Monzo used the latter tactic when another company challenged the trademark “Mondo” — within 48 hours, it received 12,000 submissions through a dedicated landing page.

7. Harness the power of AI and automation

AI (artificial intelligence) and automation are transforming the world of fintech, representing a significant shift in how financial services are accessed, delivered, and secured, offering greater efficiency, accuracy, and personalization.

Some of the applications of AI and automation in fintech include the following:

- Fraud detection and prevention: AI algorithms can analyze transaction patterns to identify and flag unusual activities, significantly reducing the risk of fraud. Machine learning models can adapt to new fraud techniques over time, offering evolving protection.

- Credit scoring and underwriting: AI can process large volumes of data, including non-traditional data sources, to assess credit risk more accurately. This can lead to more informed lending decisions and potentially expand credit access to underserved markets.

- Personalized banking services: AI enables the creation of personalized financial products and advice. It can analyze customer data to offer customized recommendations on savings, investments, and spending.

- Automated customer service: Chatbots and virtual assistants, powered by AI, can handle customer queries, provide financial advice, and assist with transactions, offering a 24/7 service that reduces the need for human customer service representatives.

- Algorithmic trading: AI algorithms can analyze market data and execute trades at optimal times based on trends and patterns that are too complex for humans to identify.

- Risk management: AI systems can assess and manage risk more effectively by analyzing market conditions, customer behavior patterns, and economic trends.

- Regulatory compliance and reporting (RegTech): AI can automate the process of monitoring and complying with regulatory requirements, reducing the risk of human error and ensuring more consistent compliance.

- Process automation (Robotic Process Automation – RPA): Automation of routine and repetitive tasks in financial operations, such as data entry, report generation, and account reconciliation, enhances efficiency and accuracy.

- Payment processing: AI and automation streamline payment processing, making it faster and more secure. They can also handle complex international transactions and currency conversions.

- Wealth management and robo-advisors: AI-driven robo-advisors provide automated, algorithm-based portfolio management advice without the need for human financial planners.

- Blockchain and smart contracts: AI can be integrated with blockchain technology for smart contracts, ensuring more secure and automated contract management in financial transactions.

- Insurance underwriting and claims processing: In fintech insurance (InsurTech), AI and automation are used for more accurate underwriting and faster claims processing.

- Anti-money laundering (AML): AI can effectively monitor and analyze transactions to detect and report activities that might be related to money laundering.

8. Partner with a professional fintech marketing agency

Succeeding in the fintech space can be a complex and daunting task — especially in a market overflowing with innovation and competition — which is why many aspiring fintech startups choose to partner with an expert agency like Literal Humans.

We have a deep understanding of the unique challenges fintech companies face and have created bespoke marketing solutions for a number of fintech providers, including Wise and Chipper Cash.

The Literal Humans team crafts narratives that resonate deeply with your audience, building trust and long-term customer relationships through our 360-degree range of customized services, from content creation to comprehensive digital marketing strategies, designed to elevate your brand in the competitive fintech landscape.

Discover how our tailored approach can transform your fintech marketing and propel your brand to new heights — learn more about our services and how we can help your business grow.