Growing your fintech business? You’re in an industry with lots of competition, so you need to stick out from the crowd. In fact, the global fintech market is projected to grow by 5.13% from 2024 to 2028, reaching a market volume of US$ 3409.00 billion in 2028, according to latest figures from Statista. Luckily, we’re experts in the field, and can help you with just about every marketing strategy you can think of!

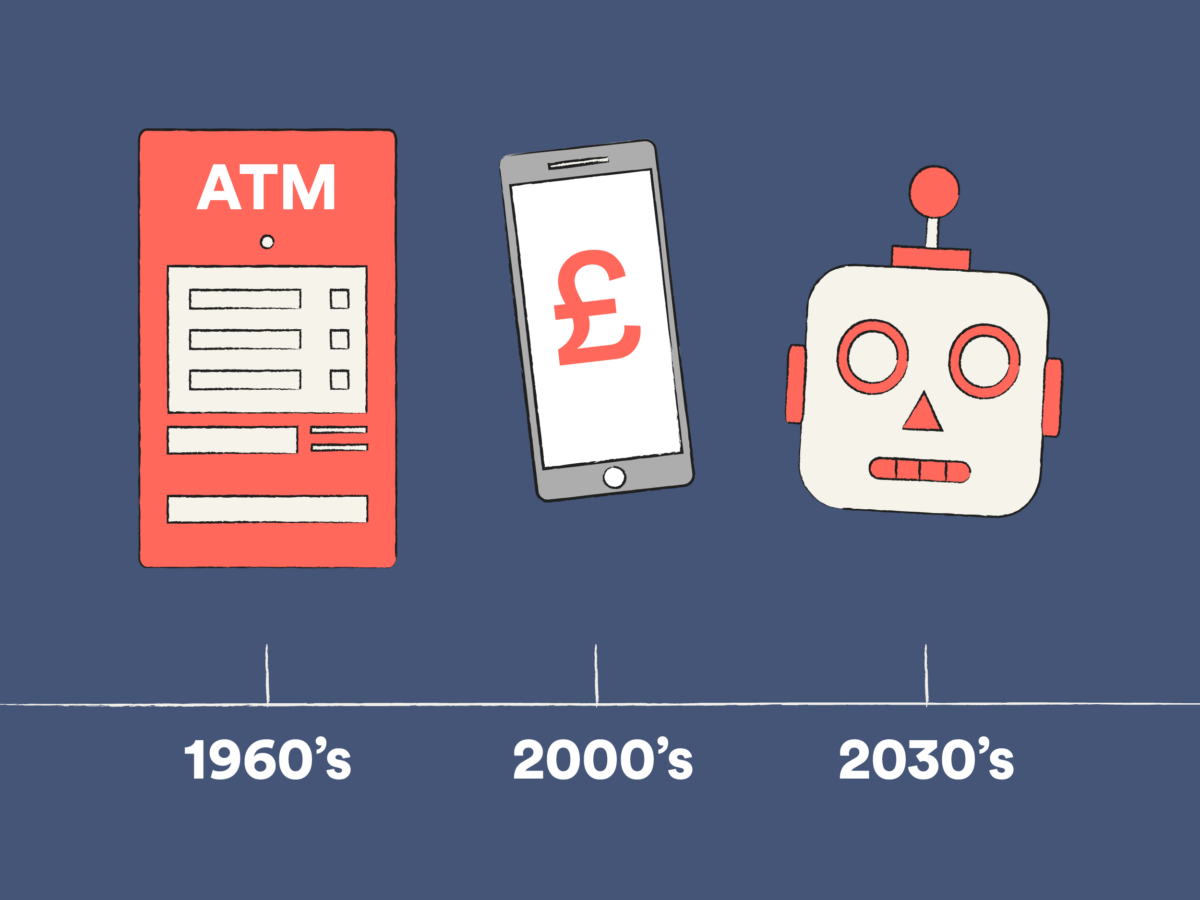

At its core, B2B fintech marketing connects businesses with the most up-to-date financial technology, to streamline and enhance processes which should, ultimately, grow the customer’s business. It’s a little different to B2C fintech marketing, which connects you directly to a user—think Revolut, or other online banks.

Fintech is one of the fastest growing industries, and has boomed over the past few years. There were over 10,000 fintech startups registered in the United States, as of 2021. By the end of Q1 in 2024, it was reported that almost a third of the fastest growing startups in the United Kingdom and Ireland were in the fintech industry. Because of this, it’s crucial to get your marketing strategy right, to reach out and connect with these decision makers in order to grow your own brand. Here, we’ll go through our top pointers to creating a solid B2B fintech marketing strategy.

H2: Strategies for B2B fintech marketing

Much like any marketing strategy, B2B fintech marketing can be split into distinct marketing efforts, each one requiring specialist skills partnered with fintech industry knowledge. This industry knowledge is key to ensuring you’re staying ahead of the curve and posting about things that matter to your audience—after all, you’re the industry leader, so you should be posting about the relevant news and trends.

When it comes to creating a B2B marketing strategy, it’s important that every aspect works well together and priorities are aligned. This means pointing towards your latest blog posts in newsletters and social channels, and covering the same topics across all platforms.

It might seem daunting to create a B2B fintech marketing strategy, but there are four core aspects to think about.

H3: Content marketing strategies

Content marketing should be a key component of any marketing strategy, whether that’s through blog posts, guides, or creating informative and clear landing pages. A B2B content marketing strategy will be able to navigate your audience through the funnel, while also creating brand awareness and boosting your share of voice.

However, when it comes to content marketing, you need to make sure you’ve got the right research and intent behind each published piece. Is the intent informational or transactional? Have you completed SEO research to help your content rank on Google? And is your content sitting on the right platform for your audience?

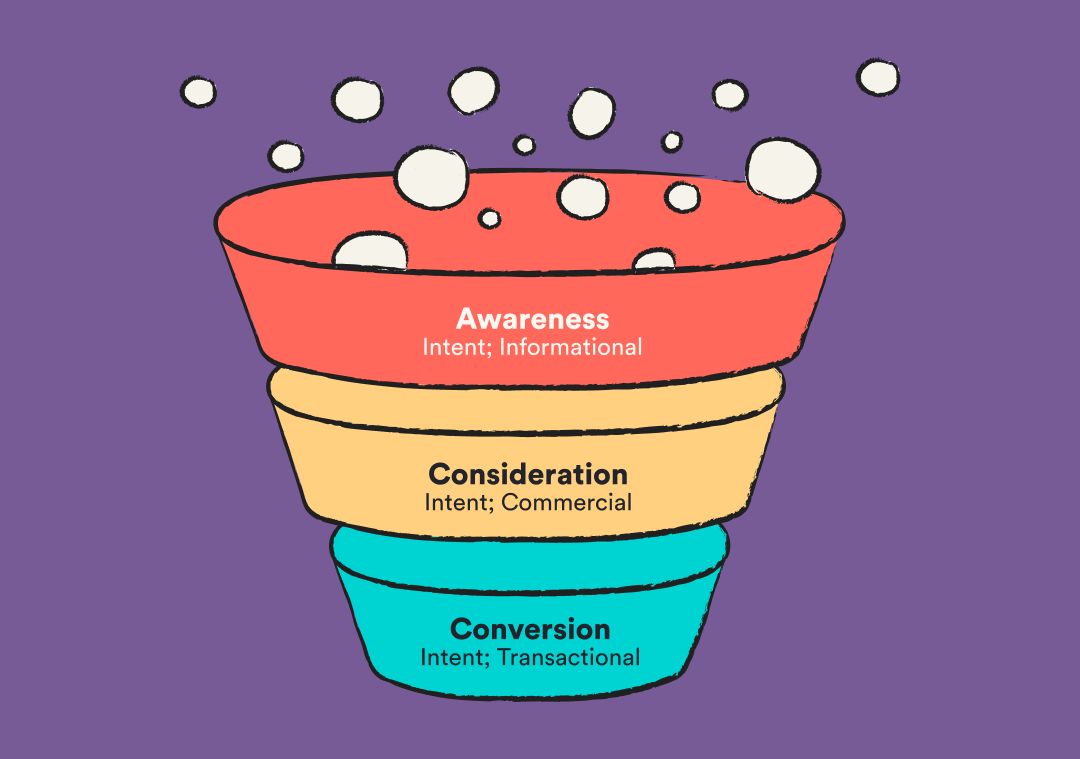

Each piece of content you produce will sit somewhere within the funnel, which can be defined by:

- Awareness: The part of the funnel that is closely linked to branding. This type of content would typically be in the form of evergreen content that’s driven by keyword research, in order to target specific questions and queries being searched for by your audience.

- Consideration: This type of content is for the 5% of in-market buyers, who are looking for financial solutions to their problems and who may be searching for answers to specific pain points that your product can help with. Producing case studies and comparison guides is key for this.

- Conversion: This bottom-of-the-funnel content should be where your readers convert. Optimizing service pages, including clear and encouraging CTAs throughout your content and ensuring all links lead back to a user-friendly product page will all help conversions.

It’s best to produce a mix of content styles as part of your strategy. You want to ideally create evergreen and newsy pieces to sit on your blog, while transactional content should sit on dedicated landing pages. Working with a dedicated fintech content marketing agency will allow you to successfully target all aspects of the funnel, while taking advantage of expert advice.

Discover more about the future, trends and predictions of fintech marketing with our guide.

H3: Website optimisation

In an increasingly digital world, it’s more important than ever to have a well-optimized and user-friendly website. And this is especially true for the fintech industry. After all, a finance tech brand should have a well-built website and an excellent digital offering.

- SEO research: Get an SEO team on board to help with keyword mapping across your website, to ensure that your content targets the right keywords. This will ensure that when users stumble across your website organically, they’re being directed to the right page from the SERPs by ranking for relevant key terms.

- Navigational menu: Creating a clear menu will help users navigate through your website. A clear navigation is crucial for user experience (UX) as you don’t want to annoy any potential customers with a clunky, clicky website. Make sure all your service pages are grouped together in the menu, and that all relevant information is easy to find. This includes things like blogs, contact information, and key landing pages.

- Clear calls-to-action (CTAs): A good CTA can be in the form of a button or within the copy itself. Its purpose is to encourage users to click through to a product page to convert, generating leads for your business. So it’s important that they’re well written. A good rule of thumb is to keep CTAs snappy—short enough to fit on a button if needed. A CTA could encourage readers to do anything that’s related to a conversion, whether that’s download a whitepaper, make a purchase, or sign up to a newsletter.

- Clear and concise website copy: Partnering nicely with the content marketing segment we spoke about previously, crafting clear and concise web copy is a crucial step in your website strategy. Creating B2B content is slightly different than B2C content, as you’re speaking directly to business owners and C-suite executives—so you need to make sure you’re speaking their language and encouraging them to factor you into their budgets.

- Clear branding: As with any business, branding is crucial. You want to ensure that it remains consistent across all platforms, so potential customers aren’t confused about whether they’re on legitimate business profiles. Keeping your tone of voice, imagery, and logos consistent also helps build credibility and generate awareness, which is crucial in the fintech industry.

H3: Email marketing

Email marketing is one of the oldest forms of digital marketing. But while signing up to newsletters evokes worries of spam and junk folders, it’s still an effective form of marketing. There are a few aspects to consider when creating your email marketing strategy, especially if you want to increase your open rates.

- Who is your audience?: Think carefully about who is on the receiving end of your emails. You may consider segmenting your lists into existing customers, new customers, or even by job title (if you have that information to hand).

- What are your goals?: Why are you sending each email blast? Do you want to generate leads, send traffic to a specific page, or draw attention to a new product offering? Make sure that your email is well crafted to get you the results you want and expect.

- Personalizing your emails: Personalized emails gain an open rate of around 29% and a click-through rate of 41%, so it’s definitely worth crafting tailored content that speaks directly to your audience.

H3: Social media marketing

Social media remains one of the best ways to build brand awareness and get your content published to the masses. When crafting a B2B social media marketing strategy, however, you want to think carefully about where your target audience is, rather than sharing information everywhere and hoping it gains traction.

For example, TikTok might not be the best platform when marketing content to other fintech professionals. Instead, you might want to shift your focus to LinkedIn.

Here are some other things to keep in mind:

- Establishing your platforms: Building out a profile and gaining a following takes time. Pick one or two platforms where you think your audience might be, and focus on building your presence. Utilize LinkedIn to connect with other fintech professionals and share your own unique industry insights. Meanwhile, Instagram is a great tool to highlight your culture and share company news.

- Establishing a posting cadence: Take some time to experiment with what works for your audience and posting schedule. Test the algorithm and see when and where you’re gaining the most engagement.

- Manage your engagement: Take the time to respond to comments left on your social accounts, keeping to your tone of voice. Be helpful and engaging, and work on building out your community so your followers stay engaged.

H2: How to measure success

Measuring success in B2B fintech marketing is key when it comes to understanding what works and what needs reworking. Keep tracking your key performance indicators (KPIs) so you can compare month-on-month and year-on-year growth to measure how your marketing strategy is working over time, and where you should pin your focus.

KPIs you should be tracking and measuring include:

- Lead generation: Tracking where your leads are coming from will allow you to focus more on the content that’s working to generate leads, and think about how you can make other aspects of your strategy better.

- Conversion rates: Conversions are crucial for all businesses, so you want to be able to track how your marketing efforts are affecting conversions. This can show any issues with the marketing funnel and may even highlight content that’s working surprisingly well—which you should try and replicate, where possible.

- Customer acquisition costs: If the cost of your customer acquisition is higher than the lifetime value of your customer, then your business isn’t viable. Tracking your CAC will allow you to streamline processes where possible, and improve your profits.

- Retention rates: Tracking customer retention allows you to make marketing decisions to improve customer retention, satisfaction and loyalty.

- Content engagement: Take the time to track sessions on specific pieces of content, as well as factors like bounce rate. This will allow you to see which content your clients are responding well to, and where you can make improvements across your website.

H2: Crafting a B2B fintech marketing strategy for sustainable growth

As of 2023, the fintech space was valued at over $226 billion, with approximately 30,000 fintech startups globally, and these numbers are only set to increase in 2024. Carving a space for your fintech business can be difficult in such a saturated market—unless you have a dedicated marketing team at your disposal.

At Literal Humans, we’re experts in B2B fintech marketing. From crafting strategies and content marketing, to assisting with branding, email marketing, and organic social, our team is on hand to help you every step of the way. Get in touch to find out more about how we can help, or schedule in a strategy session with our team.